Hey there. Ever feel like you’re just on a treadmill, working for money, and wishing you had more freedom to do what you actually *want* to do? Maybe you dream of traveling more, spending time on a passion project, or just not having to worry about bills all the time. You’re not alone! Lots of people feel this way. It’s like, life’s great, but wouldn’t it be awesome to have more control over your time? That big idea is kinda what financial independence is all about. It’s not about being a millionaire celebrity; it’s about having your money work for you so you don’t have to work just for money. In this chat, we’re gonna break down how you can actually plan for that. We’ll look at figuring out your money situation, setting goals, making smart choices, and getting your money growing so you can inch closer to that freedom. By the end, you’ll have a much clearer picture of how to start building the life you actually want.

So, What Even IS Financial Independence?

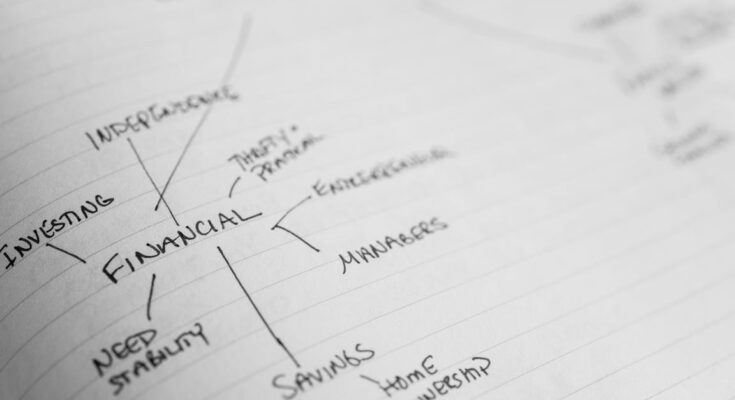

Okay, let’s get this straight. Financial independence, or FI as some folks call it, doesn’t mean you’re lounging on a yacht sipping fancy drinks all day (unless you want that!). It means you have enough money saved and invested that the money those investments make can cover your living expenses. Picture this: instead of needing a paycheck from a job to pay rent, buy groceries, or go out with friends, the money your savings and investments generate covers those things. It’s about reaching a point where working is optional, not necessary for survival. Think of it like building a money-making machine that hums along in the background, spitting out cash so you don’t have to trade your time for dollars anymore. It gives you the ultimate choice: keep working because you love it, switch to something totally different, volunteer, travel the world – whatever floats your boat!

First Things First: Where Does Your Money Go?

Alright, deep breath. Before you can plan for financial freedom, you gotta know where you stand right now. This means getting real cozy with your money situation. How much money comes in each month? How much goes out? And where is it going? It sounds kinda basic, but honestly, most people have no clue! It’s like trying to navigate somewhere new without a map. You gotta track your spending. You don’t need some fancy app (though they can help!); a simple spreadsheet or even just writing it down for a month can show you a lot. You might be surprised where your cash is sneaking off to – daily coffees, subscriptions you forgot about, impulse buys. Knowing these money leaks is the first, super important step to plugging them and redirecting that cash towards your FI goal. It’s not about judging yourself, just getting the facts straight so you can make better choices.

Figuring Out Your “FI Number”

This is where it gets interesting! To know when you’ve hit financial independence, you need a target number. How much money do you actually need saved up for your investments to cover your yearly costs? A common rule of thumb people talk about is the “4% rule.” The idea is that you can safely withdraw about 4% of your investment stash each year, and the rest grows enough to keep up with inflation and last a really long time. So, if you figure out you need, say, $40,000 a year to live comfortably, you’d aim for an investment portfolio of $1,000,000 ($40,000 is 4% of $1,000,000). That million bucks is your “FI number.” It might sound huge, but remember, it’s a goal you build towards bit by bit. Calculate your expected yearly spending, multiply it by 25 (because 4% is 1/25th), and boom – there’s your personal target. Having that number makes the goal feel more concrete and less like a pie-in-the-sky dream.

Earning More Dough: Boosting Your Income

Let’s be real, saving money is important, but increasing how much comes in can really speed things up. Think about ways you could potentially earn a little extra. Could you ask for a raise at your current job if you’ve been doing great work? Maybe pick up a side hustle? It doesn’t have to be complicated. It could be selling crafts online, tutoring, driving for a ride-share app on weekends, or using a skill you have to help others for a fee. Imagine Emily, who loved dogs. She started walking her neighbors’ dogs for $10 a walk. Doing just a few walks a week added up to an extra couple hundred bucks a month. That money went straight into savings and investing. Every extra dollar you earn and don’t immediately spend gets you closer to your FI number faster. It’s like adding extra fuel to the rocket ship!

Putting Your Money to Work: Saving and Investing Smartly

Okay, so you know where your money’s going, you’ve got your FI number, and maybe you’re even earning a little extra. Now, you gotta make that money work for *you*. Just saving cash in a regular bank account is okay, but inflation kinda eats away at its value over time. Investing is where your money can really grow. Think of it like planting seeds. You put money into things like stocks, bonds, or real estate, and over time, they can potentially grow and pay you dividends or rent. It sounds intimidating, but it can be pretty simple to start. Look into things like retirement accounts (like a 401k if your job offers it, or an IRA), which have tax advantages. Even starting with a small amount regularly can make a huge difference over many years thanks to the magic of compounding – that’s when your earnings start earning their *own* earnings! It’s like a snowball rolling downhill.

Cutting Back Without Feeling Deprived: Smart Spending

This isn’t about living like a monk and never having fun. It’s about being intentional with your spending. Once you tracked where your money goes, you can see areas where you might be spending without even thinking about it. Maybe you’re buying lunch out every day when packing from home could save you a ton. Perhaps you have subscriptions you don’t use much. Look for smart ways to reduce your biggest expenses, like housing or transportation, if possible. Could you live in a slightly smaller place? Walk or bike more? It’s about finding the balance between enjoying life now and building for the future. Ask yourself, “Does this purchase truly add value or joy to my life?” If not, maybe that money could be better used helping you reach financial freedom sooner. It’s about making conscious choices, not just blindly swiping a card.

Staying on Track and Dealing with Bumps

Planning for financial independence is a marathon, not a sprint. There will be times when things are tough – unexpected bills pop up, the economy is shaky, or you just feel discouraged. That’s totally normal! The key is to stay consistent and not beat yourself up over setbacks. If you overspend one month, just get back on track the next. If investments dip, remember that the stock market goes up and down over time, and focusing on the long haul is usually the way to go. Talk about your goals with a trusted friend or partner. Celebrate small wins along the way. Maybe hitting a savings milestone or paying off a chunk of debt. Financial independence is a big goal, but by breaking it down into smaller steps and staying persistent, you make steady progress even when it feels slow. Keep your “why” in mind – that freedom you’re aiming for!

Planning for financial independence might seem like a massive task, but as we talked about, it’s really just a series of smart steps taken consistently over time. It starts with knowing your current money situation, figuring out your personal FI number, and then actively working to increase the money coming in and be mindful of where it goes. Making your money work hard for you through smart saving and investing is absolutely crucial. And remember, this isn’t about deprivation; it’s about making intentional choices that align with your long-term goals and cutting out the stuff that doesn’t add real value. Stick with it, celebrate progress, learn from mistakes, and keep that vision of freedom in mind. By taking action on these steps, you’re building a path towards a future where you have more control over your time and your life. You got this!